Advantages

Why choose a comprehensive coverage insurance?

Our full-coverage health insurance

Discover health insurance plans that truly adapt

NEW INSURANCE

Adeslas Plena Total Vital

Full coverage and reduced copayments

With hospitalisation and dental assistance, at the same price over three years and with reduced copayments.

-

Extensive coverage including hospitalisation

-

Annual medical check-up, with a copayment of €50

-

Refund of pharmacy, rehabilitation, physiotherapy, speech therapy, phoniatry and chiropody expenses

-

Up to €30,000 in travel assistance abroad

47€ From insured/month

THE BASIC ONE

Adeslas Plena

Extra-low costs

With hospitalisation and low copayments

-

Extensive coverage, including hospitalisation

-

Reimbursement of rehabilitation, physiotherapy and podology expenses

-

Up to €12,000 in travel assistance abroad

49€ From insured/month

THE BEST-SELLING INSURANCE

Adeslas Plena Total

Comprehensive health and dental coverage

With hospitalisation, no copayments and dental care at the same price for three years

-

Extensive coverage, including hospitalisation

-

Free annual medical check-up

-

Reimbursement of pharmacy, rehabilitation, physiotherapy, speech therapy, phoniatrics and podology expenses

-

Accident coverage of up to €30,000

-

Up to €100,000 in travel assistance abroad

80€ From insured/month

Adeslas Plena Vital

The best value for money

With hospitalisation and copayments.

-

Extensive coverage, including hospitalisation

-

Reimbursement of rehabilitation, physiotherapy and podology expenses

-

Up to €12,000 in travel assistance abroad

37€ From insured/month

NEW INSURANCE

Adeslas Plena Total Vital

Full coverage and reduced copayments

With hospitalisation and dental assistance, at the same price over three years and with reduced copayments.

-

Extensive coverage including hospitalisation

-

Annual medical check-up, with a copayment of €50

-

Refund of pharmacy, rehabilitation, physiotherapy, speech therapy, phoniatry and chiropody expenses

-

Up to €30,000 in travel assistance abroad

47€ From insured/month

THE BASIC ONE

Adeslas Plena

Extra-low costs

With hospitalisation and low copayments

-

Extensive coverage, including hospitalisation

-

Reimbursement of rehabilitation, physiotherapy and podology expenses

-

Up to €12,000 in travel assistance abroad

49€ From insured/month

Adeslas Plena Plus

Without any extra costs

With hospitalisation and no copayments.

-

Extensive coverage, including hospitalisation

-

Reimbursement of rehabilitation, physiotherapy and podology expenses

-

Up to €12,000 in travel assistance abroad

59€ From insured/month

THE BEST-SELLING INSURANCE

Adeslas Plena Total

Comprehensive health and dental coverage

With hospitalisation, no copayments and dental care at the same price for three years

-

Extensive coverage, including hospitalisation

-

Free annual medical check-up

-

Reimbursement of pharmacy, rehabilitation, physiotherapy, speech therapy, phoniatrics and podology expenses

-

Accident coverage of up to €30,000

-

Up to €100,000 in travel assistance abroad

80€ From insured/month

Compare the types of coverage of our comprehensive coverage insurance policies

Adeslas Plena Vital

37€ Desde aseg/mes

Adeslas Plena Total Vital

47€ Desde aseg/mes

Adeslas Plena

49€ Desde aseg/mes

Adeslas Plena Plus

59€ Desde aseg/mes

THE BEST-SELLING INSURANCE

Adeslas Plena Total

80€ Desde aseg/mes

Duration

Annual

3 years

Annual

Annual

3 years

Copayments

Copayments with an annual maximum limit

Copayments with an annual maximum limit

With low copayments

No copayments

No copayments

General medicine and specialities

Diagnostic resources

Hospitalisation and emergencies

Preventive medicine

Pregnancy and childbirth

Implants and prostheses

Robotic surgery

Excess of €6,000

Excess of €6,000

Excess of €6,000

Excess of €6.000

Excess of €6.000

Special treatments

Transplants

Psychology and psychotherapy

Podology

Dental services

Annual medical check-up

Healthcare abroad

Up to €12,000

Up to €30,000

Up to €12.000

Up to €12.000

Up to €100.000

Reimbursement of physiotherapy and rehabilitation expenses

Reimbursement of podology expenses

Reimbursement of outpatient pharmacy expenses

Reimbursement of speech therapy and phoniatrics expenses

Health and Wellness Plans

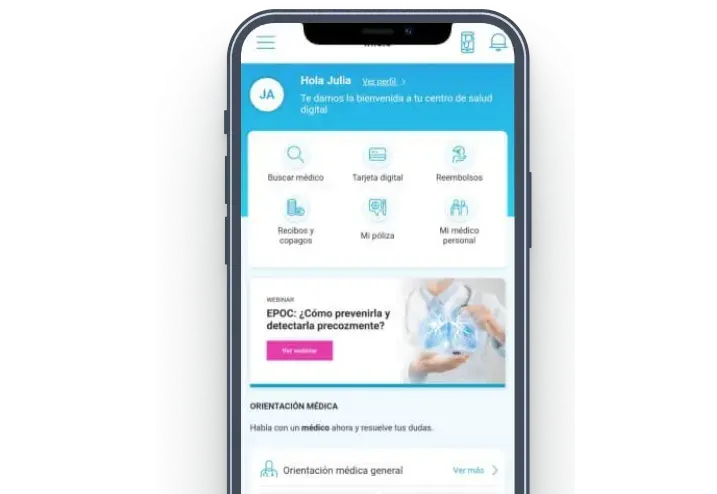

Digital health services

Accident coverage

Up to €30.000

Do you have any doubts?

Get in touch with us and we will help you choose your insurance

Frequently asked questions

The answer to all your questions

We sort out all the most frequent doubts when it comes to taking out an Adeslas private health insurance policy.

Comprehensive medical coverage in a health insurance means that it offers a broad range of medical services and treatments covering a variety of medical conditions and care needs. This includes visits to the doctor, medical examinations, hospital procedures, surgeries, prescribed medicines, etc. Hence, a comprehensive health insurance is designed to offer comprehensive protection for your health and well-being, thereby ensuring you have access to the care you need just when you need it.

The main difference between comprehensive insurance and so-called "outpatient coverage" insurance is the inclusion of hospitalisation and emergency services in the former, along with travel assistance abroad, among its types of coverage.

Yes, medical emergencies and hospitalisation are covered.

Yes, there are waiting periods. Consult the contractual terms and conditions of the type of insurance you choose.

Yes, they include medical assistance abroad.

Yes, it includes dental coverage, though some additional dental services have a "low" associated cost.

Yes, you can include beneficiaries in your policy.

The main difference between a health insurance plan with copayments and one without lies in how you share medical costs with the insurer.

-

With Copayments: In a health insurance plan with copayments, you pay a specific amount of money each time you receive medical care. These payments may vary depending on the type of medical service and are usually a fraction of the total cost. Copayments allow you to have a lower monthly premium.

-

Without Copayments: On the other hand, with a health insurance plan without copayments, you don't have to pay anything out of pocket when receiving medical care. This means that if you choose a plan without copayments like Adeslas PLENA TOTAL, you get medical attention without worrying about additional costs at the time of service.

The choice between a plan with or without copayments depends on your personal preferences and how you prefer to manage your medical expenses.

The types of copayments vary depending on the insurance plan and are related to the monthly premium and coverage. In general, the lower the premium, the higher the copayment amount. That’s why Adeslas offers the following options to clients who want full coverage while paying a lower premium:

-

Reduced: with Adeslas PLENA.

-

Limited: with Adeslas PLENA VITAL.

In general, the essential medical coverages don’t change between plans with or without copayments. Both types of insurance typically offer a wide range of medical services and treatments. The main difference lies in how the costs of those services are shared.